Business Insurance in and around Frankfort

One of Frankfort’s top choices for small business insurance.

Insure your business, intentionally

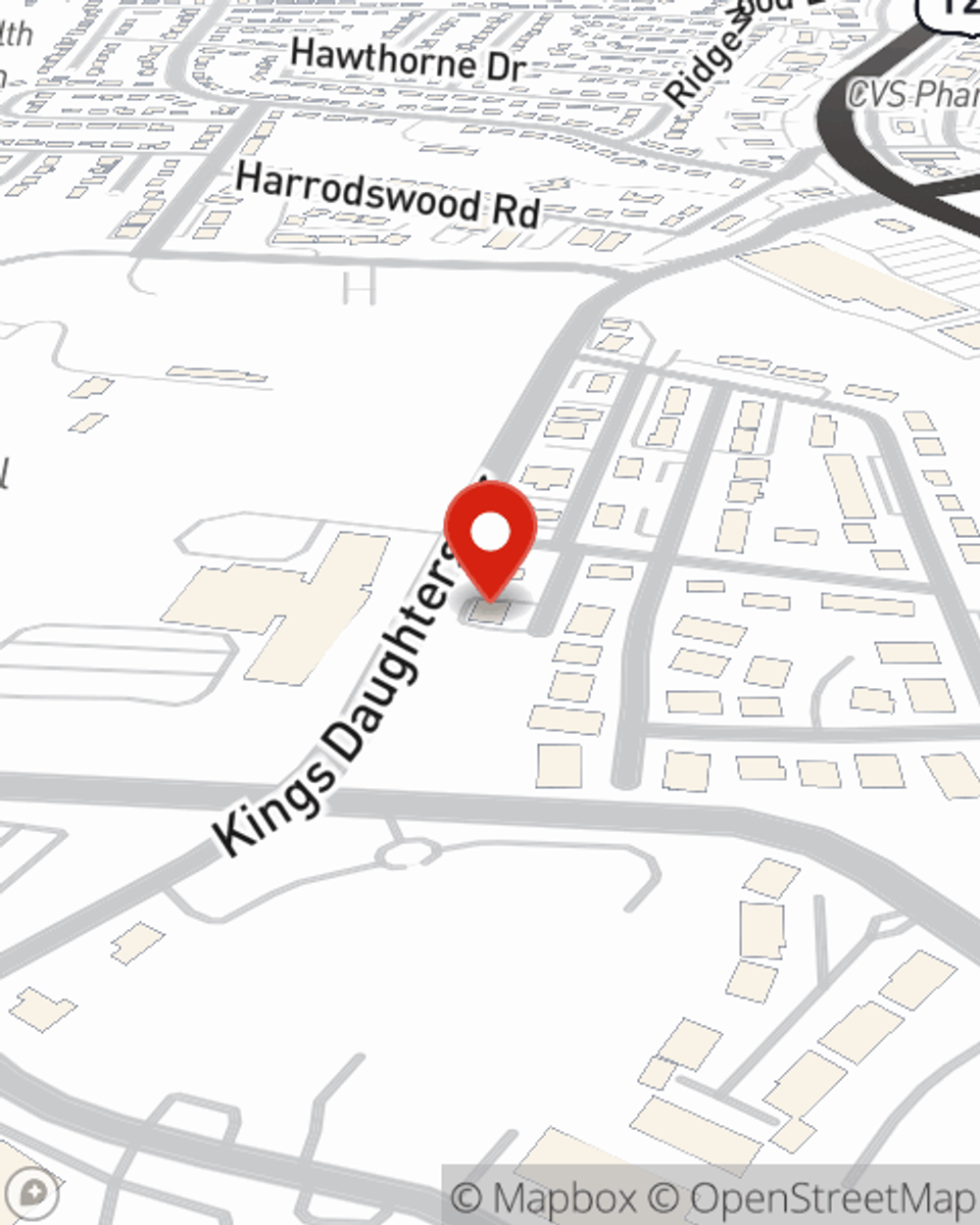

- Frankfort

- Franklin County

- Frankfort Regional

- Kentucky

- Kentucky Capitol

- Kings Daughters

Coverage With State Farm Can Help Your Small Business.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide outstanding insurance for your business. Your policy can include options such as business continuity plans, extra liability coverage, and a surety or fidelity bond.

One of Frankfort’s top choices for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

At State Farm, apply for the great coverage you may need for your business, whether it's a gift shop, a pottery shop or a clock shop. Agent Erika Hancock is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Get right down to business by getting in touch with agent Erika Hancock's team to explore your options.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Erika Hancock

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".